Guaranteed Education Plan

Subscribe to Guaranteed Education Plan and enjoy cash coupons up to MOP1,800

All parents concern the very best for their children, and one of the most important things is to ensure that they can get the best possible education. However, in view of increasing education cost, it may result as a financial burden to parents when their children pursue higher education.

As a breadwinner for your family, you want to make sure that they are financially protected. In the absence of your financial support, can your children still pursue a higher education? Can you ensure them a sufficient education fund?

Guaranteed Education Plan is an insurance product, combining protection and savings that offers guaranteed maturity benefit, assists you to achieve your savings target and provide better study opportunities for your children with a peace of mind!

- Protection for Payor

- Extension of Protection to Payor's Spouse

- Guaranteed Maturity Benefit (Savings Target)

- Fixed Monthly Premium

- Potential Non-Guaranteed Dividends at Maturity

This product is underwritten by Fidelidade Macau Life — Insurance Company Limited. The above product information is for reference only.

Download this Product Leaflet here. Please contact us for further details about the product and how to apply for it.

Protection for payor ensures you a total peace of mind

Guaranteed Education Plan offers insurance coverage that guarantees payor of continuous contribution to the education fund. In case of payor’s death or total and permanent disability due to accident or sickness, all premiums due after such unfortunate event will be waived and the child can still receive the targeted amount upon maturity.

Extension of waiver of premium to your spouse

This plan also provides additional protection for your spouse. With only an extra 5% premium, both of you can enjoy the plan's protection. If either of you suffer death or total and permanent disability due to accident or sickness, all remaining premiums will be waived. With this, it could relieve the financial burden of family and your child’s education fund is securely protected.

Prepare for your children’s future

Guaranteed Education Plan is an insurance product combining protection and savings that offers guaranteed maturity benefit. With a fixed monthly premium, you can enjoy protection during the years, ensures your child will have access to sufficient fund for tertiary education.

Flexible Saving Target with Fixed Premium

Guaranteed Education Plan offers great flexibility in planning your child's future education. You can set the saving target based on multiples of USD15,000 according to your aspiration for your child, up to USD300,000. Once the application is approved, the premium will be kept constant throughout the policy duration.

Flexible Usage of Cash

Guaranteed Education Plan guarantees your child the availability of education fund at policy maturity. You can also make the most of your fund according to different needs. Apart from pursuing higher education, you can transfer the fund to time deposit or utilize the fund to help your child setting up businesses. In case you are in short of cash, you can terminate the plan and obtain surrender benefit at anytime1.

1 Subject to the “Surrender Benefit” of the policy.

This product is underwritten by Fidelidade Macau Life — Insurance Company Limited. The above product information is for reference only.

Download this Product Leaflet here. Please contact us for further details about the product and how to apply for it.

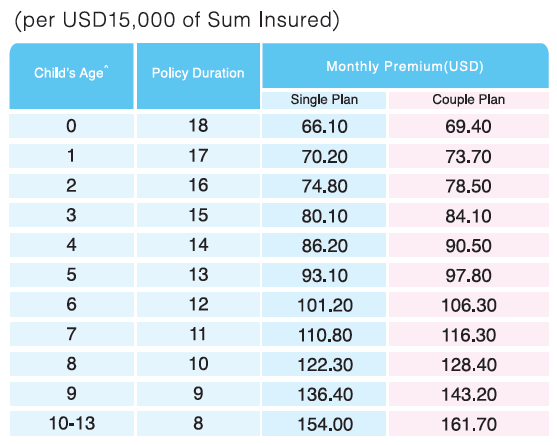

Premium Table

^ Child’s age is in complete year. For child’s age from 0 to 10, the child’s age at maturity is 18 years old.

For child’s age from 11 to 13, the child’s age at maturity is 19 to 21 years old respectively.

This product is underwritten by Fidelidade Macau Life — Insurance Company Limited. The above product information is for reference only.

Download this Product Leaflet here. Please contact us for further details about the product and how to apply for it.

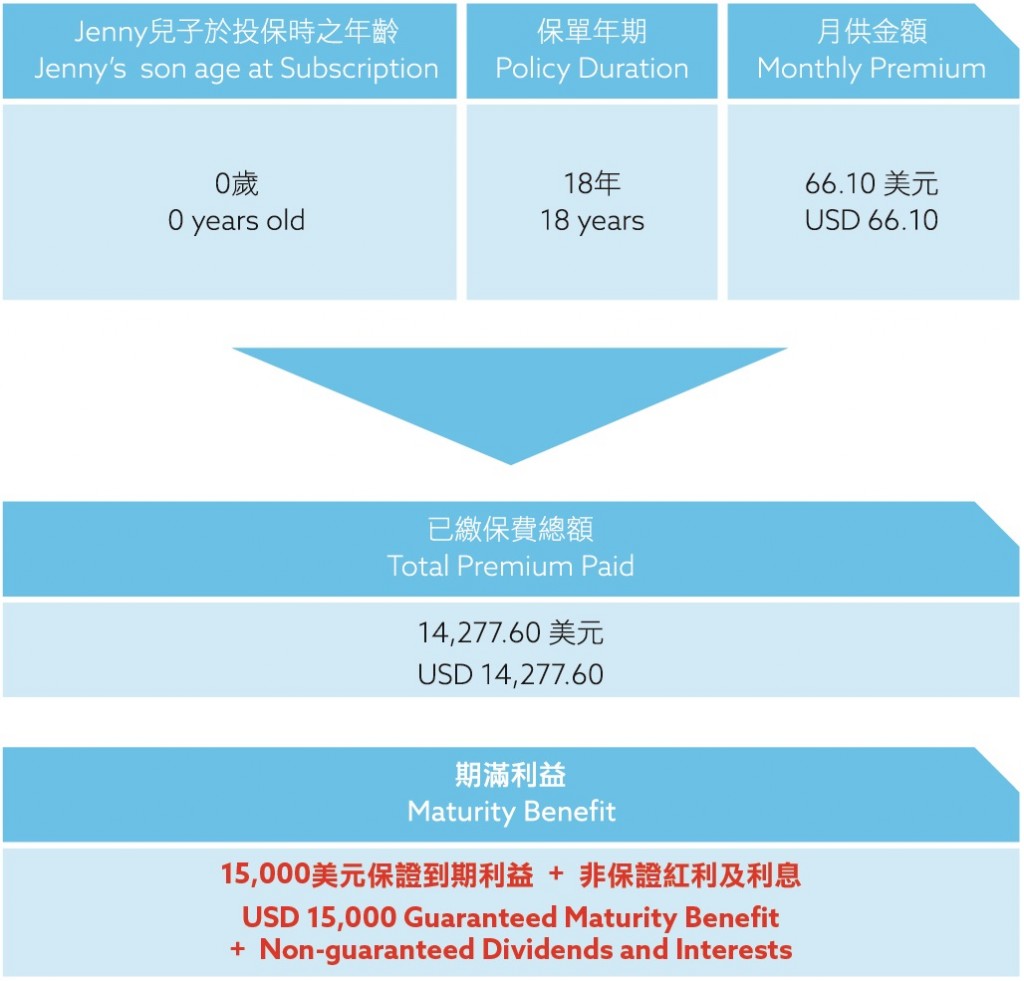

Case Illustration 1

Jenny recently gave birth to her son and has many plans for his future. Her goal is to setup an education fund to ensure that she can afford tertiary education for her new born son. She decided to subscribe to the Guaranteed Education Plan until her son’s coming of age.

When Jenny’s son reaches 18 years old, Jenny will be receiving her funds from her Guaranteed Education Plan and will be financially ready to afford her son’s tuition fees.

Case Illustration 2

Jenny subscribed to the Guaranteed Education Plan when her son was born. Four years later, she is diagnosed with terminal illness and is worried about her son’s future. Jenny knows that, even in her absence, this plan guarantees the same benefit to her son. In the unfortunate case of death or total and permanent disability, all the future premiums of this plan are waived for the same maturity benefit.

When Jenny’s son reaches 18 years old, he will receive the Maturity Benefit. Despite the absence of Jenny, he can now afford his tuition fees without concern.

This product is underwritten by Fidelidade Macau Life — Insurance Company Limited. The above product information is for reference only.

Download this Product Leaflet here. Please contact us for further details about the product and how to apply for it.