Vehicle Family Protection

In Macao, according to Motor Vehicles Insurance Ordinance of Macao, a driver and his/her direct family members are not considered as third party and, therefore, not covered by a motor insurance policy.

That's why you need Vehicle Family Protection, to protect you and your family members during your ride.

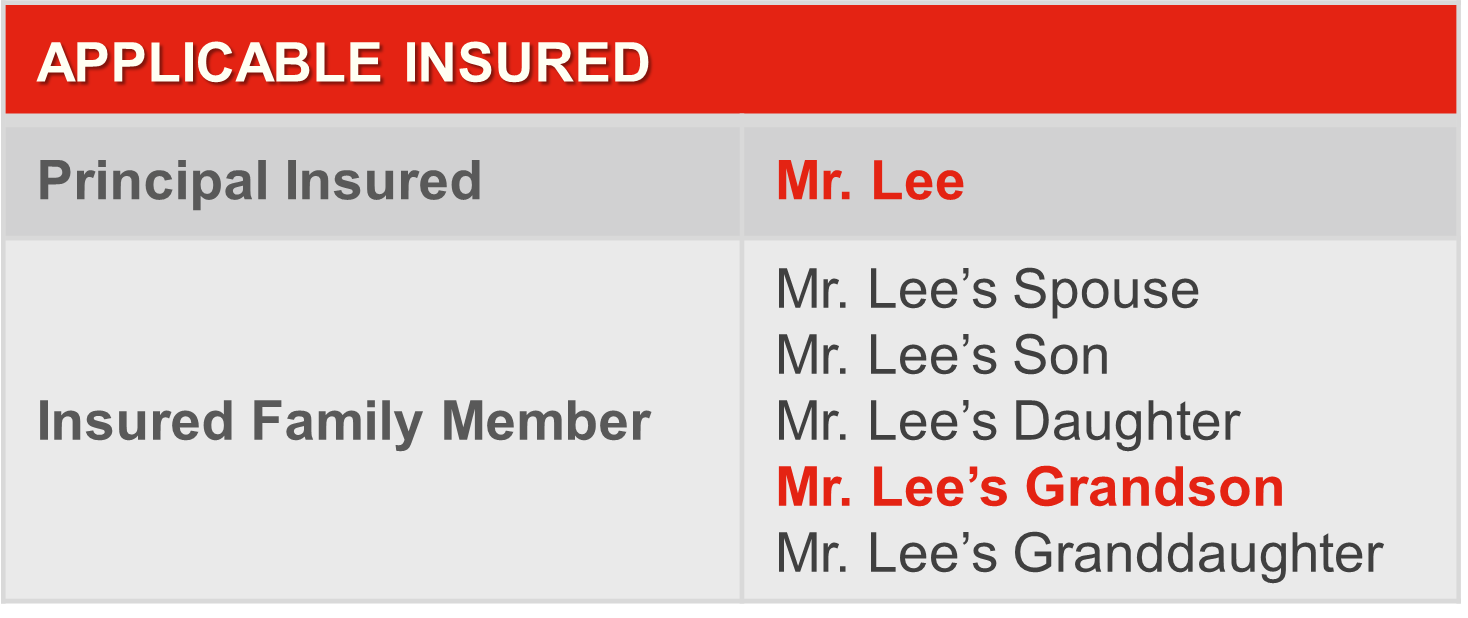

This plan financially safeguards the Principal Insured and the Insured Family Members*1 (Principal Insured’s spouse, son, daughter, grandson or granddaughter by blood, adoption, or marriage) if they are involved in a traffic accident in connection with the use of the insured vehicle in case they are injured or die.

*1 The Principal Insured’s spouse (legally or the facto) who must be between 18 and 75 years of age; and any Principal Insured’s son, daughter, grandson or granddaughter (by blood, adoption, or marriage) who must be older than 6 months of age and equal or below 75 years of age.

WHY SHOULD YOU APPLY?

INSURED FAMILY MEMBER FROM 6 MONTHS TO 75 YEARS OF AGE

INSURED FAMILY MEMBER FROM 6 MONTHS TO 75 YEARS OF AGE

DEATH OR TOTAL PERMANENT DISABILITY COVERAGE

DEATH OR TOTAL PERMANENT DISABILITY COVERAGE

MEDICAL EXPENSES IN HOSPITAL COVERAGE

MEDICAL EXPENSES IN HOSPITAL COVERAGE

FUNERAL EXPENSES COVERAGE

FUNERAL EXPENSES COVERAGE

SIMPLE APPLICATION

SIMPLE APPLICATION

This product is underwritten by Fidelidade Macau - Insurance Company Limited. The above product information is for reference only.

Download this Product Leaflet here. Please contact us for further details about the product and how to apply for it.

WHERE IS COVERAGE APPLICABLE?

|

MACAO

|

HONG KONG

|

CHINA

|

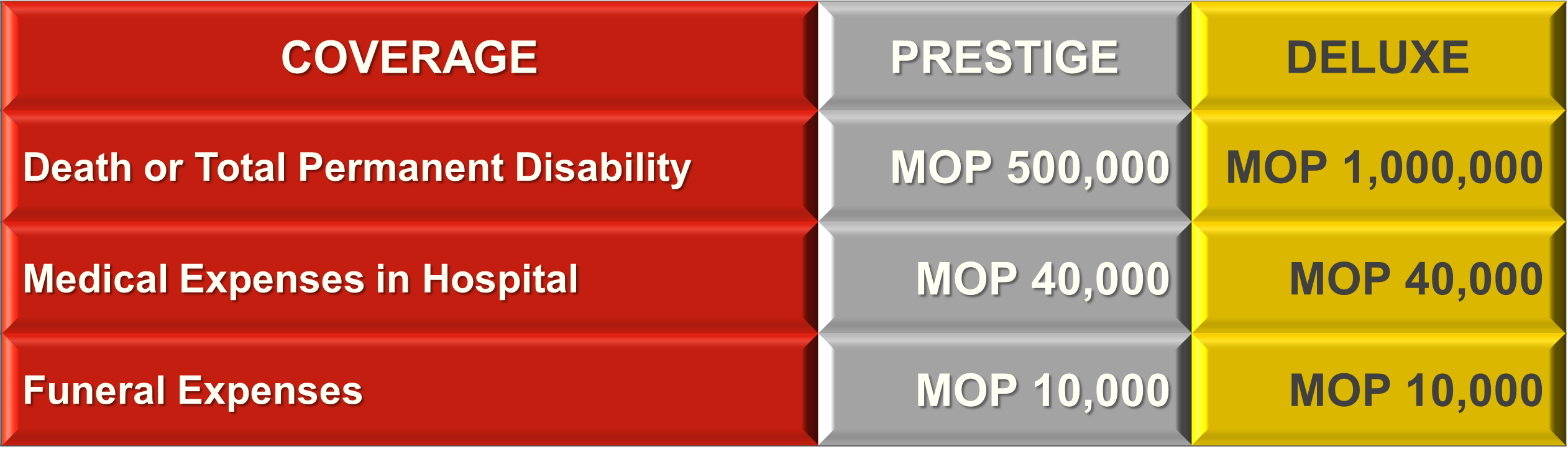

WHAT DOES IT COVER?

MAXIMUM BENEFIT AMOUNT PER PLAN TYPE

Please refer to the information below for details of coverage.

![]() DEATH OR TOTAL PERMANENT DISABILITY

DEATH OR TOTAL PERMANENT DISABILITY

A lump sum benefit will be paid to the relevant beneficiary(ies) in case of the death of the Insured or the Insured suffered from Total Permanent Disability due to a traffic accident involving the Insured being a driver or passenger in the vehicle insured by Fidelidade Macau.

The benefit amount shall be the maximum compensation amount in respect to all the Insureds in aggregation.

The compensation amount to be paid shall be the maximum benefit amount stated in the Policy Schedule divided by the number of seats of the vehicle covered under the motor private car policy stated in the Policy Schedule or, if it unequivocally can be proven to the satisfaction of Company, divided by the number of Insured involved in the Accident.

![]() MEDICAL EXPENSES IN HOSPITAL

MEDICAL EXPENSES IN HOSPITAL

The actual, reasonable and medically necessary expenses incurred in a hospital for medical, surgical and dental treatment recommended by a physician are covered.

The maximum benefit amount is in respect to all Insureds in aggregation per policy year, subject to the sub-limit of MOP5,000 per Insured per policy year.

![]() FUNERAL EXPENSES

FUNERAL EXPENSES

The funeral expenses shall be reimbursed to the person who can prove having incurred such expenses, against the receipt of documentary evidence.

The maximum benefit amount is MOP10,000 per Insured.

This product is underwritten by Fidelidade Macau - Insurance Company Limited. The above product information is for reference only.

Download this Product Leaflet here. Please contact us for further details about the product and how to apply for it.

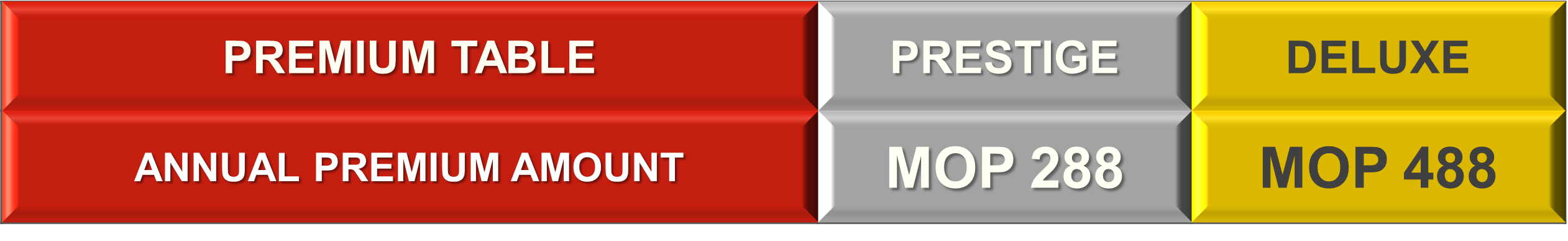

WHAT ARE THE PREMIUM DETAILS?

PAYMENT MODE

PAYMENT MODE

⇒ ANNUAL (renewable until the age of 75 years of the Principal Insured)

PLAN CURRENCY

PLAN CURRENCY

⇒ MOP (MACAU PATACA)

PREMIUM AMOUNT PER PLAN TYPE

PREMIUM AMOUNT PER PLAN TYPE

HOW CAN I APPLY?

Find the application requirements below.

PRE-CONDITION

PRE-CONDITION

⇒ Customer should have a valid Motor Insurance policy (For Private Cars) issued by Fidelidade Macau - Insurance Company Limited.

AGE

AGE

⇒ Principal Insured: 18 years - 75 years

⇒ Insured Family Member: 6 months - 75 years

DOCUMENTATION NEEDED

DOCUMENTATION NEEDED

⇒ Macao Resident ID Card / Non-resident Worker’s ID Card

PAYMENT MODE

PAYMENT MODE

⇒ Autopay BNU Bank Account or BNU Credit Card

⇒ Cash

This product is underwritten by Fidelidade Macau - Insurance Company Limited. The above product information is for reference only.

Download this Product Leaflet here. Please contact us for further details about the product and how to apply for it.

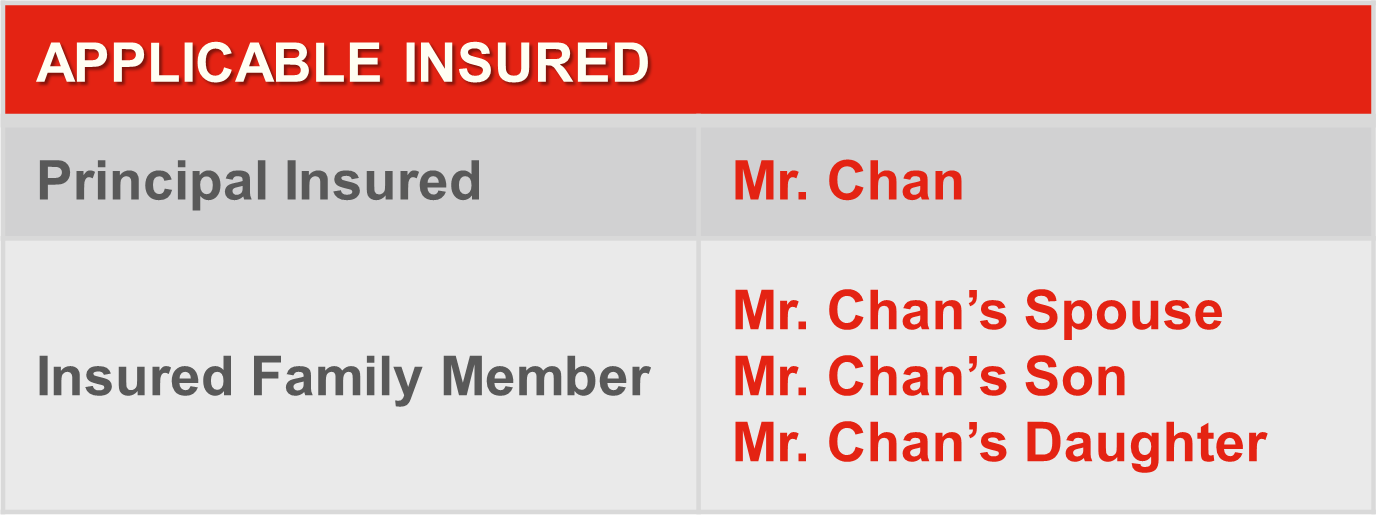

FIND OUT SOME EXAMPLES OF CUSTOMER STORIES

![]() CUSTOMER STORY 1

CUSTOMER STORY 1

Mr. Chan has a Motor Insurance policy issued by Fidelidade Macau. He subscribed to the Deluxe Plan of Vehicle Family Protection to protect his family during his ride on the insured vehicle.

One morning, Mr. Chan drove his wife to work and his kids to school, and unfortunately they got into an accident with their car, all of them got hurt and were sent to a hospital to receive treatment.

![]() WHAT COMPENSATION CAN MR. CHAN’S FAMILY GET?

WHAT COMPENSATION CAN MR. CHAN’S FAMILY GET?

They could make a claim based on the “Medical Expenses in Hospital” coverage. It means ALL actual, reasonable and medically necessary expenses incurred in the hospital for medical, surgical and dental treatment as recommended by a physician and which are incurred in the one-year period following the date of the accident.

The maximum benefit amount is subject to the sub-limit of MOP5,000 per Insured per policy year.

![]() CUSTOMER STORY 2

CUSTOMER STORY 2

Mr. Lee retired last year. After his retirement, he helped to look after his grandchildren and drives them to and from their school every day.

One afternoon, Mr. Lee picked up his grandchildren as usual and on their way home, and unfortunately they got into an accident with their car, Mr. Lee and one of his grandchildren got hurt and were sent to a hospital to receive treatment.

As Mr. Lee’s car is insured by Fidelidade Macau and he has also subscribed to the Prestige Plan of Vehicle Family Protection, Mr. Lee and his injured grandchild are covered under this policy.

![]() WHAT COMPENSATION CAN MR. LEE GET?

WHAT COMPENSATION CAN MR. LEE GET?

He could make a claim based on the “Medical Expenses in Hospital” coverage. It means ALL actual, reasonable and medically necessary expenses incurred in the hospital for medical, surgical and dental treatment as recommended by a physician and which are incurred in the one-year period following the date of the accident.

The maximum benefit amount is subject to the sub-limit of MOP5,000 per Insured per policy year.

This product is underwritten by Fidelidade Macau - Insurance Company Limited. The above product information is for reference only.

Download this Product Leaflet here. Please contact us for further details about the product and how to apply for it.