Guaranteed Capital

Fund Investment Objective and Policy

♦ The objective of the Fund, in a long-term perspective, is to achieve a stable and consistent valorization of the contributions of sponsors, members and contributors, by investing in a diversified portfolio of global bonds. The Fund is suitable for investors with reduced investment risk tolerance (low risk profile). Investment performance and returns may go down as well as up.

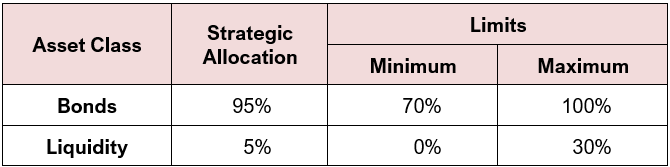

♦ The composition of the Fund’s portfolio shall take into account the following core objectives and the respective allocation ranges for each asset class described below:

In addition to directly held bonds, whether of fixed or floating rate, the class of bonds includes any other instruments that allow exposure to bond markets, including shares of investment funds whose investment are made up exclusively by bonds.

Guaranteed Capital

♦ The value of the contributions towards the Fund, net of subscription fee (if any), has capital guarantee upon the redemption of the total accrued benefits of a Member under any of the following events as per the legislation in force:

(a) Old age retirement;

(b) Early retirement;

(c) Permanent incapacity for work;

(d) Death;

(e) Serious illness;

(f) Long-term unemployment;

(g) Termination of employment, regardless of the reason of such termination, subject to a minimum of 3 (three) complete years period from the starting of the contributions towards the Fund in the name of the respective Member.

♦ Without prejudice to the provisions stated in item (g) above, the Fund unit price as of 31 December each year will be guaranteed for the Fund Units maintained on that date.

Fund Risk Profile

♦ Low

Fund Risk Disclosure

♦ Past performance of the Fund is not a guide to the future.